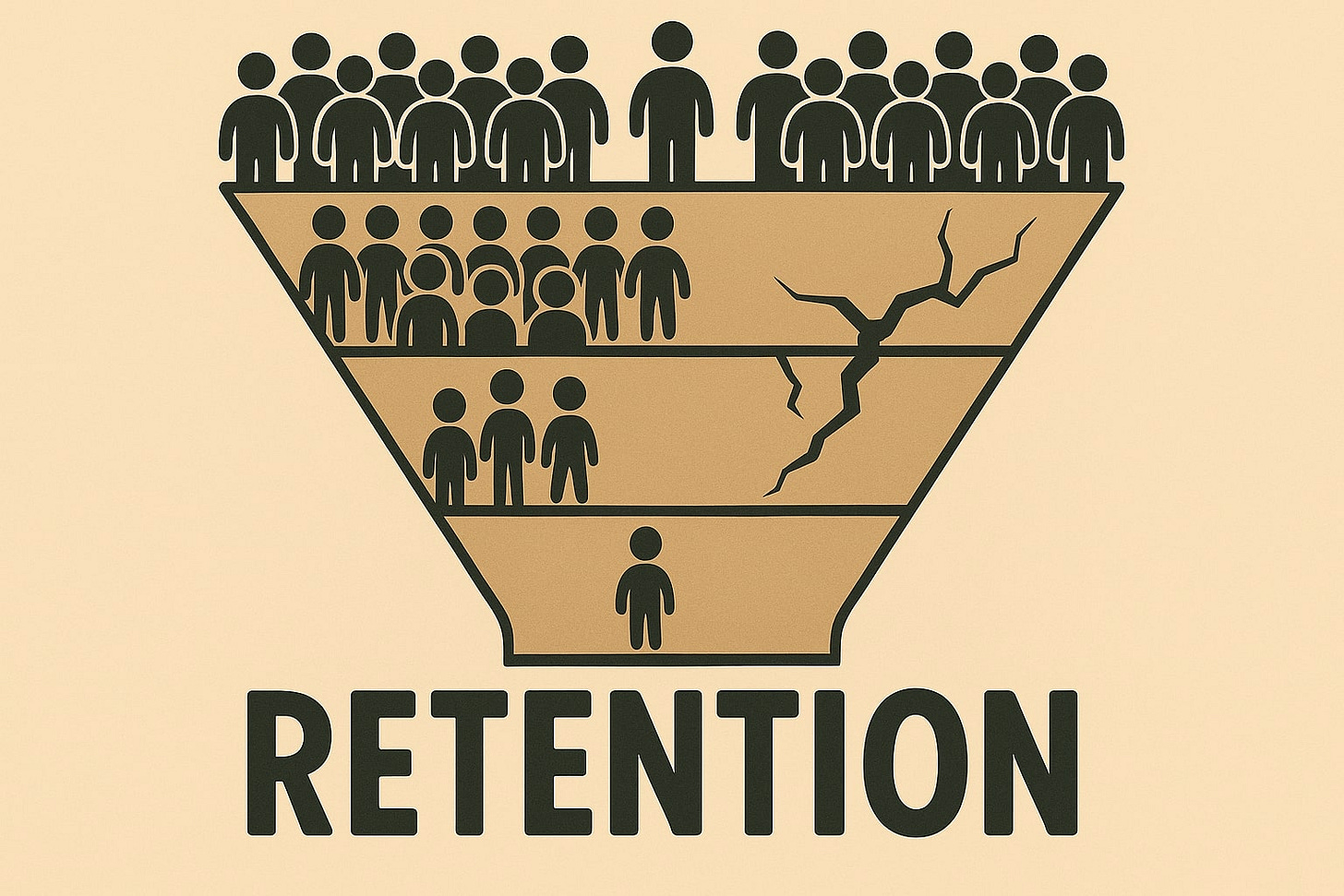

AI has broken retention - here’s how to fix it and what to measure instead

AI products activate users fast, but retention doesn’t hold. Here's how to rethink your metrics and build for long-term value.

I’ve noticed a pattern across many AI companies I work with: their launch is strong, they generate momentum that leads into awareness, adoption, and even spikes of revenue.

But then… retention doesn’t hold up.

Industry data tells a similar story:

Net revenue retention (NRR) is trending down across public SaaS companies, with private ones following suit

Average ARR growth rates have dropped from 30–40% to just 11% post-AI where top-of-funnel is not making up for weaker retention and expansion revenue

Early-stage products still capture user curiosity quickly, but annual growth slows down once they hit the $1M ARR mark

The fact that this is happening post-AI is not a coincidence.

As AI becomes more prevalent - either in native products or embedded in existing ones - it reshapes user behavior and makes some of the traditional growth metrics misleading when it comes to retention and value.

For growth leaders, this isn't just a product problem, it's a strategic challenge that will define which companies scale and which plateau.

If you're building or scaling an AI product, it's not enough to optimize for adoption. Now, you need to understand what drives return behavior, long-term value, and monetization that lasts.

Why AI retention is so weak

The top of the funnel isn’t the issue. AI products are great at generating awareness and initial usage. What breaks down is the middle: going from trying the product to making it part of a routine.

Here are the major trends I’m seeing that impact retention in AI products:

1. The AI tourist funnel: come for X, stay for… nothing?

The “come for X, stay for Y” model has long been a staple of SaaS growth.

Users enter the product with a specific job-to-be-done and, over time, discover new features that keep them around. For example, someone might start using Canva to design a social media post, then stay for brand kits, templates, and team collaboration.

Some AI-powered products still pull this off. Descript, for instance, attracts users for a specific task (say, transcribing audio) but then gets them to stay for podcast editing or social video creation.

However, in many AI products, the model doesn’t hold up.

AI tourists, driven by widespread FOMO around AI technology, are trying products not because they have a clear use case, but because they don't want to fall behind, or are exploring the dozens of AI tools available.

Traditionally, every product team’s goal was to make it as frictionless as possible for users to have the most premium experience in free plans. Zero-friction trials are proof of this. They might have been a winning strategy in the pre-AI era, but they’re now more harmful than helpful.

Offering free credits comes at a real (and sometimes high) cost for AI companies, unlike traditional SaaS, where usage is virtually free to serve. But that money doesn’t even buy them loyalty.

Some AI tourists might pay briefly. But their low intent, combined with virtually zero switching costs, is the baseline for a predictable behavior: they use up all the credits and then easily switch to a competitor.

2. Activation happens much faster

AI products often show value immediately. A user writes a prompt, gets an output, and feels like they’ve experienced the product’s value in under one minute. That’s the opposite of traditional SaaS, where activation usually involves completing setup, connecting integrations, or collaborating with other users, for example.

Activation happens fast. But that’s not necessarily good news. For growth teams, it means that the original product engagement-based activation metrics may no longer predict retention.

At the same time, many AI products are point solutions, built to solve a single job in a single moment (think removing a background image). That makes lifecycle strategy more important from day one. Once the initial value is delivered, what brings the user back?

If you don’t build for re-engagement from the beginning with notifications, contextual product nudges, or emails, users will likely churn soon after the first use.

This shift means teams need to stop thinking of activation as the goal and start focusing on value delivery and return behavior as soon as the first output. That’s the real predictor of retention in AI products.

To measure that return behavior effectively, track:

Pre-signup intent: What surfaces or use cases brought in users? These are early signals of what users expect from the product.

Signup intent: In AI products, users often describe what they want in natural language. You can run both qualitative and quantitative analysis on this to uncover the user’s true goals and segment them based on intent.

Early output generation: How quickly are users generating their first outputs? The best products deliver value in seconds or minutes, and that first successful output is a strong signal they’ll come back for more.

Together, these help establish a “golden metric” for AI products: total AI outputs generated per user.

3. Monetization is still being figured out

AI companies might look mature from the outside, with polished pricing pages, big-ticket plans, and clear tiers. But in reality, most are still running experiments.

While traditional SaaS products priced outcomes in fixed tiers, AI products are shifting toward output-based pricing. After all, outputs are the tangible results users care about in AI.

But this creates new tradeoffs.

First, outputs aren’t cheap, each generation takes real compute power. That means even free users can rack up costs, especially if the product takes multiple attempts to get a usable result.

Second, usage doesn’t always translate to perceived value. A user can burn credits and still walk away feeling like they got nothing useful.

This gap between cost, value and timing is one of the reasons lifecycle strategy now directly impacts monetization. If you want to grow revenue, you need to actively guide users toward successful outputs and then toward upgrading.

What to do about it

If you’re building or growing an AI product, here are the three tactics I would focus on to make sure you build a product that can outlast AI tourism.

1. Qualify intent early

Don’t wait for churn to tell you someone is not a fit.

In traditional SaaS, it made sense to let users explore the full product before introducing friction. In AI, that approach gets expensive. Fast. Every output costs money, and the wrong users burn resources without ever converting.

A better approach is to weed out AI tourists early: introduce upgrade prompts from the beginning and gate advanced features, to make sure the people using the product have clear intent.

It might feel counterintuitive, but in this new environment, friction is a feature. A few ways to do it:

Use opt-in reverse trials: show the premium experience first, then pull it back unless they upgrade

Start with credit card trials to filter out casual interest

Default to annual plans instead of easy monthly churn

The key is to capture intent while it’s hot. AI curiosity fades quickly, so the moment users express interest is also your best shot at converting them for the long-term.

2. Make value obvious

Once you’ve introduced friction, pair it with clear demonstrations of value.

These could take several forms, such as:

Consumption banners on the side bar

Displaying the user’s current plan type in the top navigation

Making it easy to consult the different plan types with in-product pricing pages, highlighting what the user has access to vs. what they’re missing out on

Real-time notifications, whether in product or via email, can take this even further. Let users know what they’ve used, what’s still available, and what an upgrade would unlock for them.

When value is visible, conversion becomes a lot more straightforward.

3. Rethink activation around return behavior

As mentioned above, in AI products, traditional product engagement signals are not predictive of retention. Instead, teams should focus their attention on a new golden metric: AI outputs over time.

AI activation rate = [X] AI outputs in [Y] daysNot only single outputs, but outputs over time. Think “X AI outputs within Y days”. For example, for Canva AI, it might be “3+ AI images generated within 7 days”.

Habit loops that generate repeated value are the new best indicator for long-term retention. The best teams define these habit loops explicitly and build lifecycle nudges around them.

Retention isn’t dead, it’s just different

AI changes how users behave, so it’s on us to change how we design and build products.

Curiosity brings users in, but habit and repeated value are what keep them around. For growth teams, this means we can’t rely on old SaaS metrics or playbooks anymore. We need to redefine what value looks like and build the systems that allow users to experience it.

Retention is still possible. We just need to approach it in a smarter way.

The growth leaders who recognize this shift early and adjust their strategies accordingly will be the ones building the AI companies that still matter a few years down the line.

If this gave you a new lens on retention, I’d love to hear how you plan to apply it.

great piece, Sandy! especially the point on fast activation breaking traditional retention models.

one thing I'd add is how little output count correlates with emotional stickiness. great products don’t just get used: they become trusted, satisfying, even fun. in the AI world, the expectation for ‘magic moments’ and 'wow effects' is higher, but those alone rarely sustain long-term behavior.